And if I want to retire before the age of 66 and four months, what requirements do I have to meet to be able to do so?

The statutory retirement age of 2023 is already in 66 years and 4 months. The “dream” of retirement at 65 years of age is increasing year by year, due to the 2011 pension reform, which delays the retirement age with the right to receive 100% of the benefits. However, the possibility of early withdrawal still exists, although it was recently modified.

The goal is for the legal retirement age in 2027 to be 67 for those who have contributed less than 38 years and six months; In the event of reaching this amount of contributions to the common fund of Social security Yes, you can reach full retirement at age 65. However, there are still options to stop working before what is specified in the standard.

Those wishing to retire before the normal date that suits them according to age and contribution should know that they are subject to a reduction in the retirement pension that they will receive: “The amount of the pension resulting from applying to the general regulatory base, the percentage that corresponds on the basis of the months of contribution, will be subject to reduction by progression, for each month or part of a month, at the time of the occurrence of the event, the worker lacks attainment of the statutory retirement age which in each case results from the application of the transactions which result from a table shorthand transactionsaccording to the approved subscription period and the months prior.” In other words, for each month he is expected to retire, the pension is due less, according to certain proportions.

but not only the amount is important in this case, but it will be necessary that you have attained, at the latest, less than two years of age, to the required age which applies in each case. A minimum period of contribution to social security 35 years.

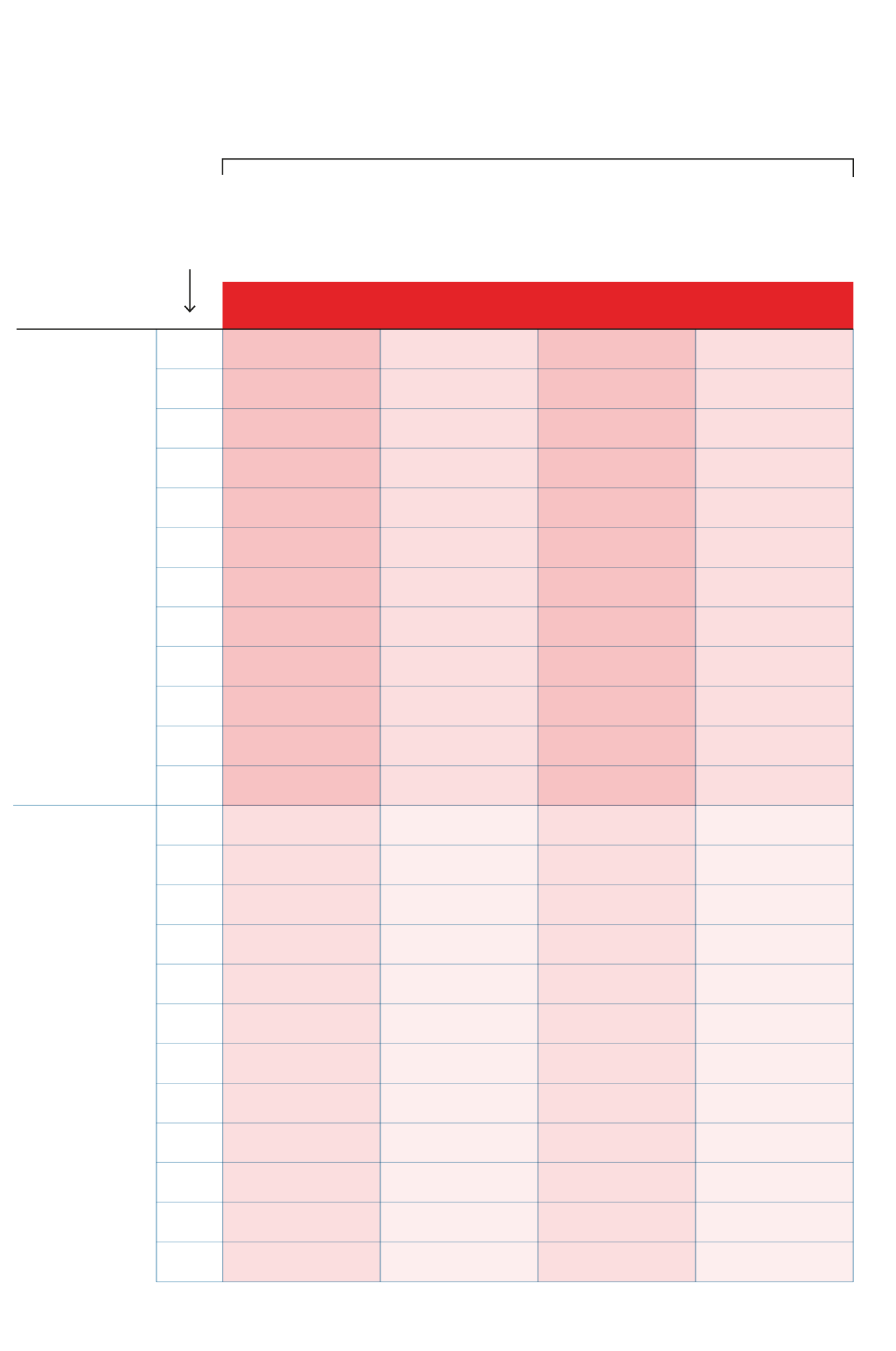

Early retirement penalties

Subscription period and % discount

Over 38 years old

and 6 months and under 41 years and 6 months

Over 41 years old

And 6 months and under 44 years and 6 months

Months

This is in the future

the retirement

less

38 years

and 6 months

Penalties

for early retirement

Subscription period and % discount

Plus

38 years

and 6 months and under 41 years and 6 months

months that

come forward

the retirement

less

38 years

and 6 months

more than

41 years old and

6 months and less than 44 years and 6 months

months that

come forward

the retirement

the Optional early retirement It can take up to two years before that. And for each projected month, the person’s penalty percentage changes (see graph). For example, a worker who retires 24 months before his due date and has a contribution period of less than 38 years and 6 months, a reduction factor of 21% will be applied; With a contribution equal to or greater than 38 years and 6 months and less than 41 years and 6 months, the reduction in the pension is 19%; With a contribution equal to or greater than 41 years and 6 months and less than 44 years and 6 months, the reduction will be 17%; And after he contributed the equivalent or greater than 44 years and 6 months, the clip was reduced to 13%.

The more years of contributions, the lower the cut. Just as the shorter the time to retire, the smaller the cut, too. In the first of these examples, with a contribution of less than 38 years and 6 months, the reduction becomes 4.89% if the withdrawal is expected within only 10 months, and 3.26% if it is provided for only one month. In this sense, the lowest coefficient to be applied is 2.81% in the event that retirement is deferred by one month, and after having contributed the same or more than 44 years and 6 months.

for an issue post-service retirement Things change a bit as this can be done four years earlier than the normal life a person deserves. The resulting reduction in pension also varies and, in this case, ranges from a 0.50% reduction for one month in advance if you have contributed for 44 years and six months or more, up to a 30% reduction if made four years in advance with a contribution of less than 38 years and six months .

delay retirement

On the other side of the scale are those who do not want to retire when they are due and continue to work past the legal age. And doing so has a reward, for the consequent satisfaction of the SSA. A person who voluntarily delays the moment that coincides with retirement will receive an economic supplement in the annuity when he finally retires.

This amount can be collected in different ways. In the first place, it can be obtained as an additional percentage of 4% for each full year of contributions after reaching the normal age, which means an increase in the amount of the pension; Alternatively, it may be received as a fixed rate amount for each year of contributions, which will depend on the years contributions were made upon reaching retirement age, which will From 5,000 to 12,000 euros approximately and received at the time of retirement; Both formulas can also be combined.

Apart from this, delaying the withdrawal until after its due date generates other benefits such as exemption from contributing to Social securityExcept for temporary disability (reduced work).